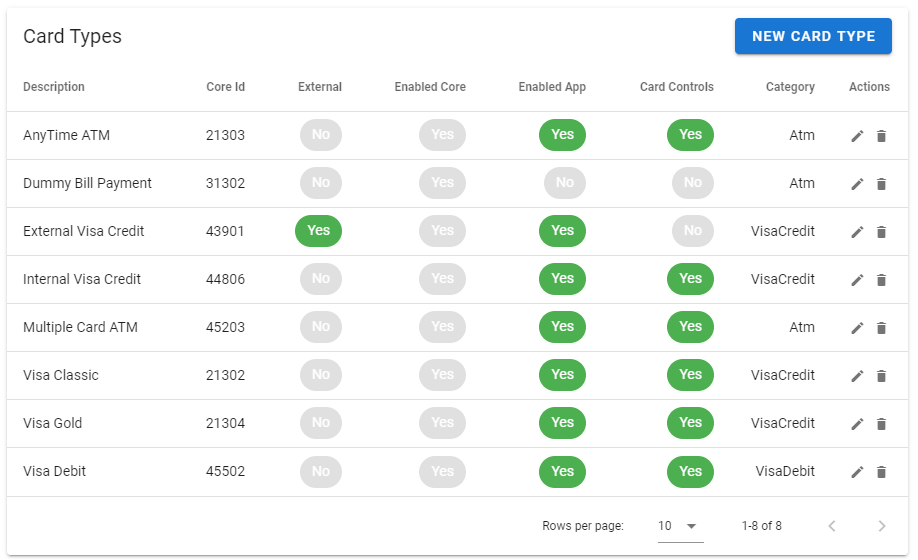

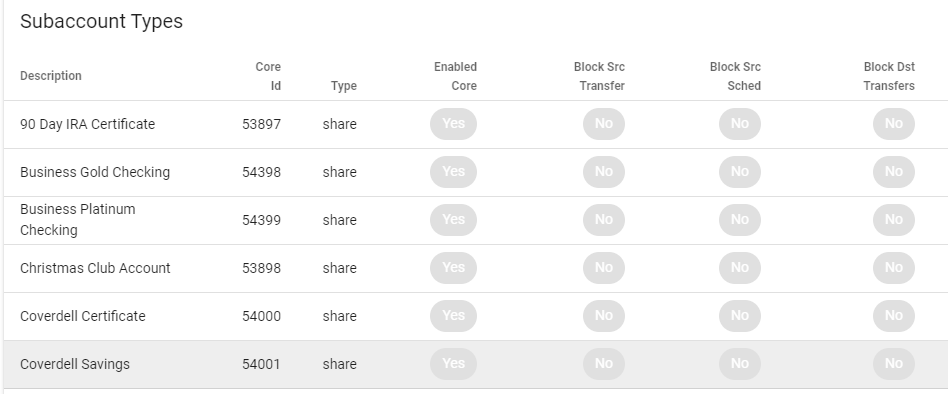

We do things a bit differently here at Mahalo. One of those things is how we handle core types–the share, loan, account, and card types of the core system. We attach configurations to these core types that allow fine grained control of a wide range of features. However, instead of manually inputting all the types, we query the core system for up-to-date information.

When a new share, loan, card, or account type is added to the core, it will show up in our admin portal automatically. Once there, you can disable transfers, enable bill pay, or add card block features for that type. You can even disable a card type so that it doesn't appear in the apps anywhere. Great for those pseudo card records that are needed but you don't want to show them to members. However, that's just a few of the features we support based on the core type.

Dynamic type configuration supplements the core functionality, it doesn't replace it. Say, for instance, you want to block scheduled transfers to a "Super Savings" share type, but still allow immediate transfers. That's a tough one to configure in the core system, but simple to configure on the Mahalo side.

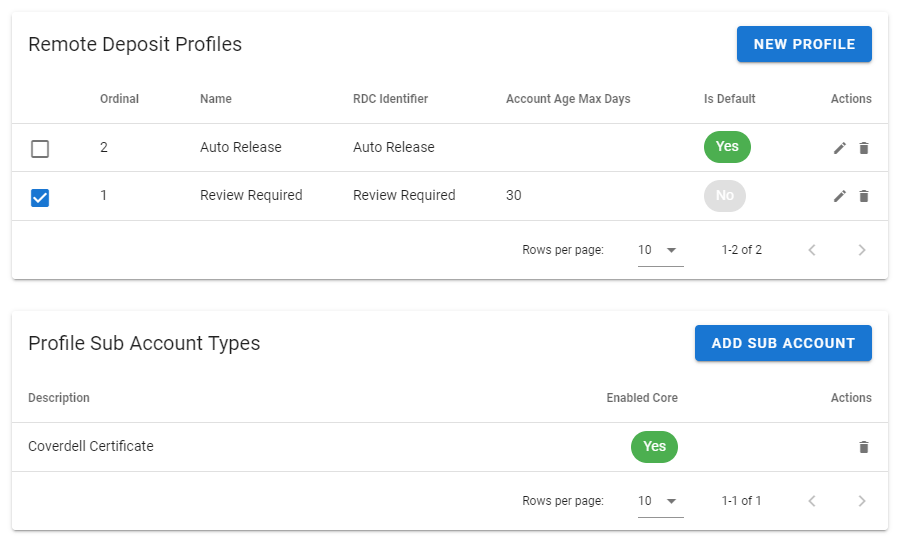

Risk profiles also take these types into consideration. Most credit unions have a checking account type that indicates the member is higher-risk. Maybe it's a starter account with a secured deposit or a member trying to rebuild their credit. If the type is configured for high-risk, we pass this info along to the mobile deposit vendor, where they place lower limits on deposits or place all deposits into a must-review queue for that member. It's all about risk management with these types of accounts.

Ensuring changes can be made quickly and correctly is at the heart of the core types sync process. It's well known that manual entry of this type of configuration is error prone. If we can remove the possibility of misconfiguration, it makes for smoother operation of your digital banking platform and less support calls, which is a win-win all the way around.