16 Dec 2025

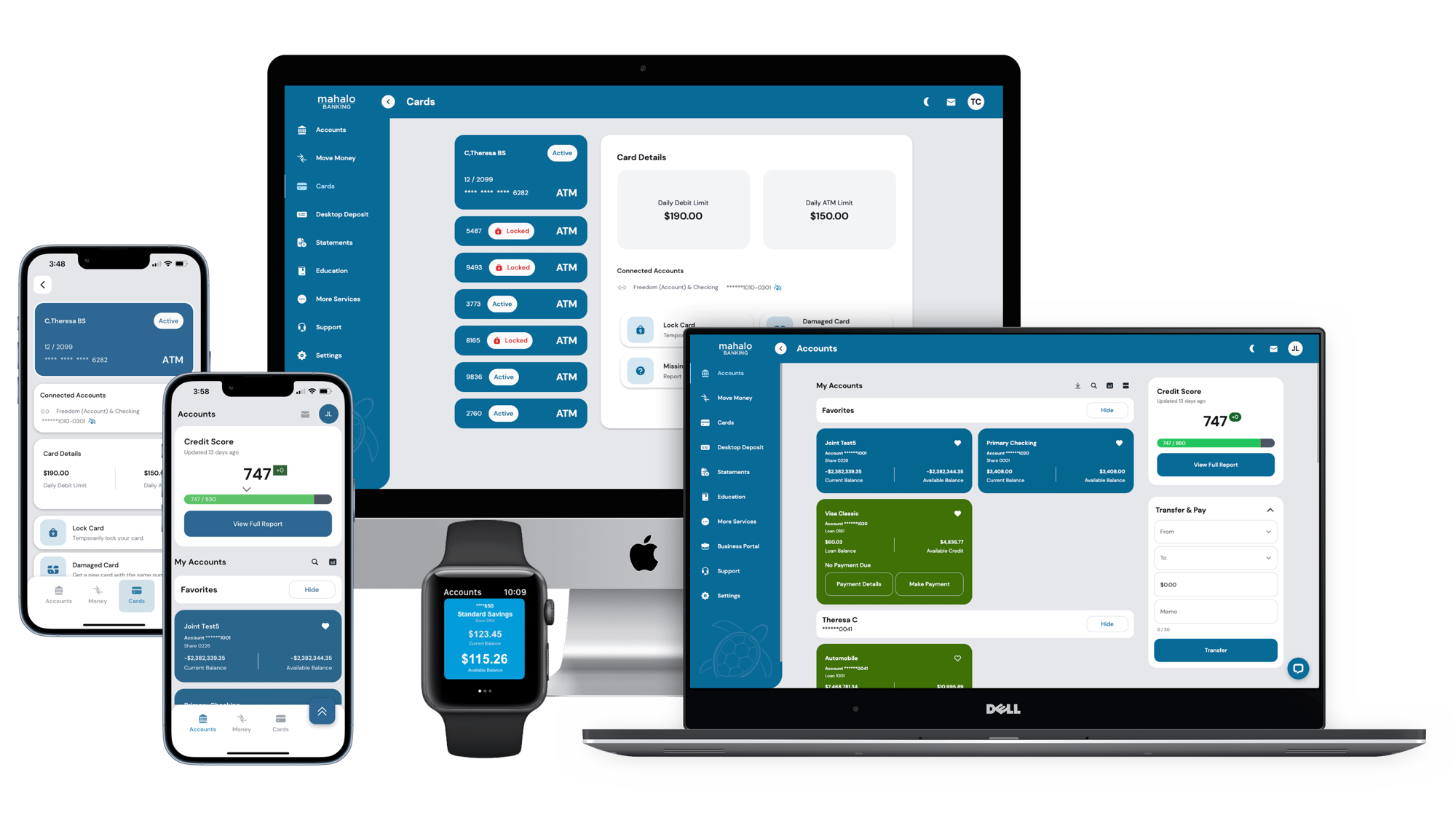

Thoughtful Banking

For credit unions that care about their

members digital experience.

The solution you need for the members you serve!

Service Driven Digital Banking to help you grow and retain your membership!

- Compete in the Digital Age

- Protect Members from Fraud

- Optimized Member-Centric Experience

Completely Custom, Fully Integrated

Money Movement

Navigate your finances with ease and security, transferring funds swiftly across accounts just like an Outrigger carrying coconuts to grandma.

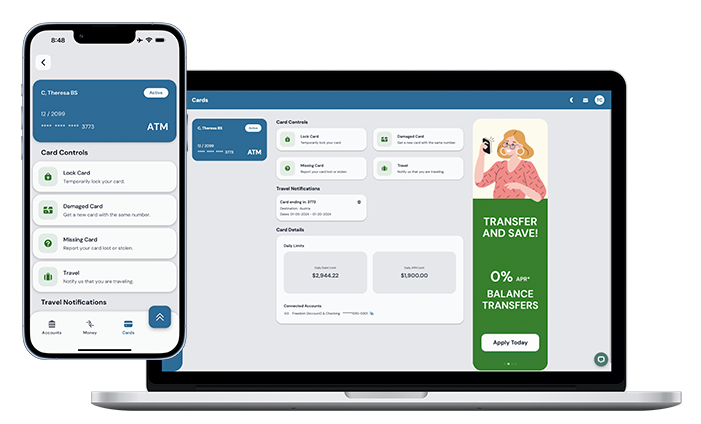

Card Controls

Our intuitive card controls will allow your members to manage and protect their credit cards and debit cards in the same place.

Business Banking

Our Business Banking platform allows you business members to offer services to small and medium-sized operations which is integrated directly into the consumer platform providing a seamless user experience between them. Your business account users can manage items such as ACH for payroll, automated payments and billing, account roles and permissions, activity monitoring, personalized credit and debit cards linked to specific accounts, and financial reporting.

Deep Core Integration

With Deep Integrations into your credit union core, Mahalo enables real-time data syncing, streamlined operations, and enhanced collaboration, fostering a more synchronized and productive environment for you and your members.

Money Movement

Navigate your finances with ease and security, transferring funds swiftly across accounts just like an Outrigger carrying coconuts to grandma.

Card Controls

Our intuitive card controls will allow your members to manage and protect their credit cards and debit cards in the same place.

Business Banking

Our Business Banking platform allows you business members to offer services to small and medium-sized operations which is integrated directly into the consumer platform providing a seamless user experience between them. Your business account users can manage items such as ACH for payroll, automated payments and billing, account roles and permissions, activity monitoring, personalized credit and debit cards linked to specific accounts, and financial reporting.

Deep Core Integration

With Deep Integrations into your credit union core, Mahalo enables real-time data syncing, streamlined operations, and enhanced collaboration, fostering a more synchronized and productive environment for you and your members.

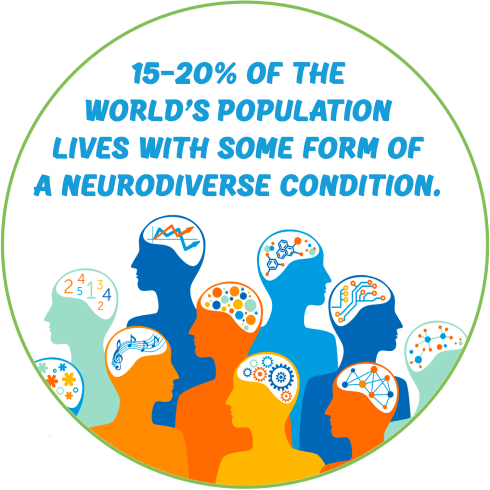

Neurodiversity and Digital Banking

Each member is unique and deserves the same opportunities while performing their digital banking.

Mahalo's redesigned platform features several new functionality options targeted to cater to those neurodiverse abilities and cognitive distinctions.

Among the platform's new features are left and right-hand use modes, font color options for those with Dyslexia or visual impairments, and the ability to disable animations for individuals affected by Epilepsy.

Don’t Just Take Our Word For It

Being a service oriented organization, it is important to us that all of our Credit Union clients receive the level of service they deserve and that they provide to their members.

“Throughout the entire process, Mahalo has kept us abreast of all the implementation nuances, which is paramount to a successful product launch. We discovered that our teams are culturally aligned and have established a truly collaborative partnership. Their hands-on approach has led them to meet and exceed all of our deliverable deadlines, as well as achieve an excellent

implementation.

Tanya Holland

Park View FCU

"In the past, we have worked with vendors who have over committed to providing services for us and our members, and then under-performed in the delivery. It is refreshing to work with a team that is credit-union first and was able to meet each of our expectations, on time and without issue. We look forward to a long and successful partnership with Mahalo."

Erin Johnston

Rocky Mountain Credit Union

"The Mahalo conversion was a monumental success. Their credit union experience allows us to share a common language and when we talk thru a custom program, MAHALO can speak our language. Truly a great partner and looking forward to many years of success!"

Travis Frey

Dover FCU

Tanya Holland

Director of Digital Operations

Erin Johnston

VP of Product Change

Travis Frey

CIO

You Are Protected

Credit Unions are facing an unprecedented rise in credential stuffing attacks. At Mahalo, we decided to do something about it.

Introducing Credential Assurance Technology (CAT), the only solution that guarantees the elimination of credential stuffing attacks without the need for Captchas or bot detection.

Never Offshore

The digital age has made you and your members’ data more vulnerable than ever. With security at the forefront of our architectural design, you can rest easy. We have never, and will never use offshore development because when it comes to your members' security and data, Mahalo doesn't cut corners.

OUR Values

To advance the state of digital banking service and technology for credit unions.

SECURE

Financial systems need to be secure. Adhering to cybersecurity and encryption best practices is priority number one.

TRANSPARENT

To foster lasting relationships with our partners, transparency is key. We'll give good news, we'll give bad news, but there won't be surprises.

INNOVATIVE

We examine existing practices and challenge ourselves to push the boundaries of ingenuity. This allows us to create things that are continuously improving.

AGILE

Plan, try, learn, repeat. Embracing the feedback loop results in resilience, responsiveness, and adaptability in a constantly shifting market.

MODERN

People expect modern, quality, and intuitive digital experiences when interacting with mobile apps and websites. Mahalo is here to raise the bar for credit unions.

COLLABORATIVE

No one knows your members better than you. Working closely together ensures everyone's success.

RESPECTFUL

We embrace diversity and inclusion. Mahalo is committed to promoting an environment where all partners and members of our team know they will be respected and heard.

We hear you. We are you.

We're credit union people helping credit unions. With over 200 years combined experience working in credit unions, the credit union industry is part of our DNA. We know the frustrations caused by poor service from a vendor that is felt by your membership. As a CUSO, we know that you deserve the same level of service you provide your members. We're ready to partner with you to make that happen.

Let us show you a true member-centric experience

Request a demo

Inside the Turtle Shell

09 Dec 2025

12 Nov 2025